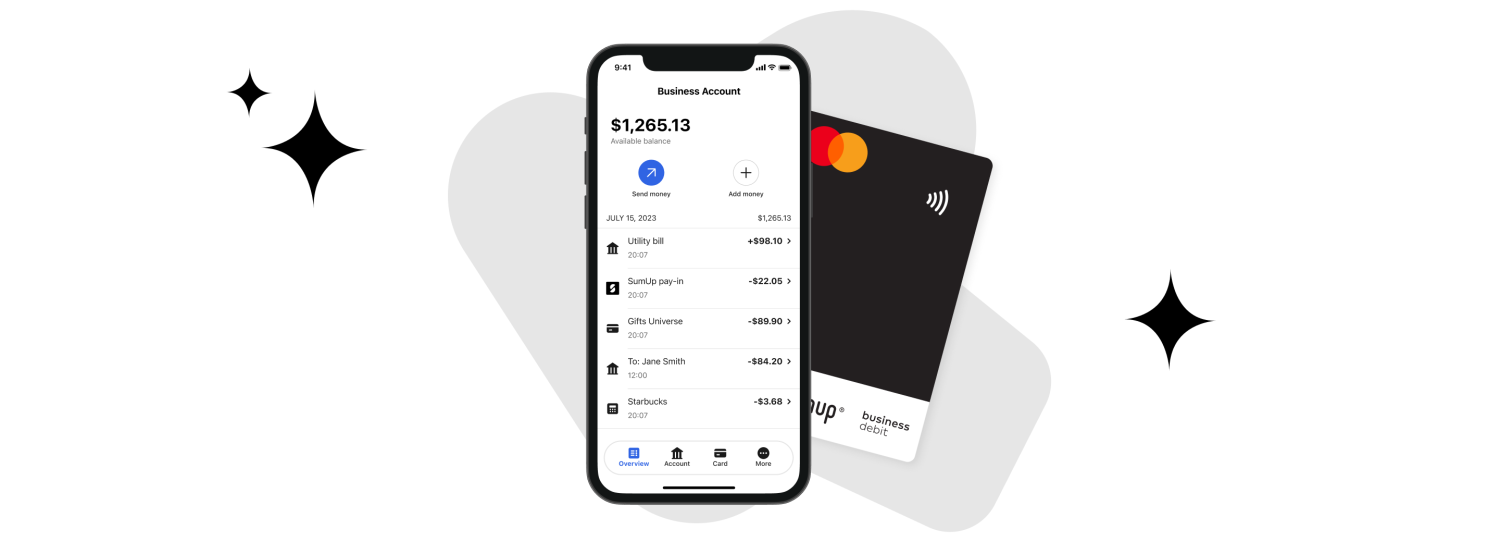

The SumUp Business Account* is full of features that keep you and your small business in control of your finances — anytime, anywhere. No hassle. No sneaky fees.

Ready for business

Open your SumUp Business Account in just a few clicks. Plus, get a SumUp Mastercard® for your day-to-day business expenses.

Same-day bank transfers

Save more time and money every day with unlimited ACH transfers and next-day deposits directly into your SumUp Business Account*.

Peace of mind

Need to change your PIN or freeze your card? Rest easy knowing you can update your account and card security at any time from the SumUp App.

A business account for any budget

Send and receive money, spend on your business and manage your finances—all from the convenience of your phone.

$0

Account opening

$0

Monthly fees*

$0

Minimum balance

A business account for any budget

Send and receive money, spend on your business and manage your finances—all from the convenience of your phone.

$0

Account opening

$0

Monthly fees*

$0

Minimum balance

Spend worldwide

Pay in shops, apps and online with your SumUp Mastercard® Debit Card.* Spend and withdraw at home or abroad, wherever Mastercard® is accepted.

Go cardless

Prefer to pay with your mobile device? Add your card to Apple Pay directly from your SumUp App and speed through checkout.

Stay in control, 24/7

Enable phone notifications, set your PIN, and freeze your card if it gets lost or stolen—all from the SumUp App.

Managing your finances all in one place

Enjoy an easier way to manage your money with a SumUp Business Account* and the SumUp App. No paperwork. No fees in the fine print.*

Cash flow management

Keep your business and personal finances separate to easily track your cash flow, with your earnings and expenses all in one place.

Extra business tools

Get a card reader, invoice clients, or send payment links — all from the SumUp App.

Fast setup

Open your business account 100% online. No paperwork. No hassle.

Statements

Stay tax-ready with account statements in either PDF or CSV format.

Easy access

Manage your money directly from your SumUp App to get the bigger picture.

100% secure

Change your PIN or freeze your card directly from the SumUp App, any day, any time.

More ways to manage your money

More ways to manage your money

Extra tools

Create invoices, payment links, QR codes and more in the free SumUp App.

Easy transfers

Quickly transfer money directly through the SumUp App with a wire or ACH transfer.

Scheduled payments

Regularly pay suppliers? Skip the hassle and schedule your payments ahead of time.

Phone notifications

Stay in control with instant phone notifications after each transaction.

Account statements

Keep easy records with downloadable statements in PDF and CSV format.

Need a hand?

We're available Monday - Friday from 9 am - 7 pm EST. Call us, or send us an email.

Banking made for your small business*

When you use a free SumUp Business Bank Account*, you get the benefits of traditional banking* and the freedom to manage your funds from anywhere. With zero monthly fees* and no hidden costs, SumUp Business Bank Accounts* are an affordable solution for small businesses.

| Feature | Cost/Fees/Limits |

|---|---|

SumUp Business Account opening | Free |

The SumUp Mastercard® Debit Card | Free |

Card Purchase (online, in-store, Apple Pay, Google Pay) | $2,500 per transaction |

ACH Daily Transfers | $1,000 per day |

Monthly Fee | $0 |

Overdraft Fee | $0 |

Minimum Balance | $0 |

Max ATM Withdrawal Amount | $500 per day |

Wire Transfer (Domestic) | 1 free per month otherwise $20 |

Check Issuance | Free $2,500 per check |

Mobile Check Deposit | $1,000 per day $5,000 per month

|

Let's get down to business

You can open your business account with SumUp in under 10 minutes.

Sign up

Tell us a few details about your business

Get verified

All we need is some ID for us to verify you

Start banking

Your account is open—add money to make your first transfer

Let's get down to business

You can open your business account with SumUp in under 10 minutes.

Sign up

Tell us a few details about your business

Get verified

All we need is some ID for us to verify you

Start banking

Your account is open—add money to make your first transfer

Business Bank Account* FAQs

- What do I need to open a business account?

- How fast can I open a business account?

- Is SumUp a bank?*

- How long does it take to get my free SumUp Mastercard® Debit Card* in the mail?

- How can I view my Business Bank Account* details?

- How do I fund my Business Bank Account?*

- Where can I find more information about my SumUp Business Bank Account?*

- How much does it cost to open a business account?

*SumUp is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC.

Conditions and exceptions apply — see Deposit Account Agreement. Other fees may apply, see fee schedule above for more information.

The SumUp Mastercard® Debit Card is issued by Piermont Bank, Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Spend everywhere Mastercard® debit cards are accepted.

Next-day payouts are only available when used alongside your SumUp merchant account.